Table of Contents

Agent banking has become one of the fastest-growing businesses in Nigeria. With POS terminals popping up on almost every street corner, it’s now easier for people to send and receive money, especially in areas where banks are far away. But this growing convenience also comes with a rising risk of robbery.

There have been reports of POS agents being attacked, shops being looted, and cash stolen – sometimes in broad daylight. Criminals are targeting agent locations because they often hold large amounts of cash and have little or no security in place.

If you’re an agent banker or POS operator, protecting yourself, your money, and your customers must be part of your daily routine. In this post, you’ll learn practical, real-world steps to prevent robbery and stay one step ahead of criminals trying to take advantage of your business.

Understand Why Agent Locations Are Targeted

Before you can prevent robbery, you need to understand why agent banking locations are such attractive targets for criminals. It’s not random. Most of the time, thieves are looking for places with high cash flow, low security, and predictable habits, and many POS shops fit that description.

Here are some of the most common reasons agent locations get targeted:

- High Cash Volume: You’re dealing with money all day. Customers deposit, withdraw, transfer, and pay bills, and most of it involves physical cash. That makes your shop a moving bank, especially on market days or month-ends.

- Predictable Routines: Many agents open and close at the same time every day. They also make bank runs around the same time. Criminals notice these patterns and use them to plan attacks when they know you’ll have the most cash on hand.

- Minimal Security Presence: Most POS agents work alone or with an assistant. No security cameras. No guards. No emergency plan. To robbers, that’s an easy win.

- Poorly Lit and Isolated Locations: Some shops are hidden in corners, alleys, or low-traffic areas with no street lights or neighbour presence. If no one can see you, no one can help you.

Recognizing these weak spots is the first step. You can’t afford to run your business like nothing will happen. The more you understand how criminals think, the better you can stay ahead of them.

Choose a Strategic and Secure Location

Where you set up your agent banking shop can make all the difference between safety and vulnerability. A well-chosen location can discourage robbers before they even make a move.

Here’s what to consider:

- Stay Visible: Pick a spot that’s in clear view of pedestrians, drivers, and nearby businesses. Avoid hidden corners or back alleys where you can’t be seen or heard.

- Go Where People Are: Markets, bus stops, busy junctions, or inside larger stores tend to have higher foot traffic, and that means more eyes, which discourages attackers.

- Consider Co-locating: Sharing space with another business – like a pharmacy, supermarket, or phone store – adds an extra layer of security. You’re not alone, and there’s likely more lighting and activity.

- Check the Lighting: Make sure your area is well-lit, especially if you open early or close late. Darkness makes it easier for criminals to approach without being noticed.

- Proximity to Help: Being near a police post, vigilante checkpoint, or even a busy motor park can act as a deterrent. Criminals tend to avoid areas where a quick escape is difficult.

- Use Your Environment Wisely: Position your desk so you can monitor the entrance. Install mirrors or glass to see behind you. Don’t sit with your back to open space or hidden corners.

Expert Tip: Location isn’t just about getting customers; it’s also about staying alive and in business. The right location can reduce your risk without costing you anything extra.

Limit Cash Exposure

Cash is what criminals want, and the more you hold, the more attractive your shop becomes. If they believe you’re sitting on a large pile of money, you become a target. Simple as that. So, one of the smartest ways to protect your business is to keep as little cash on hand as possible.

Here’s how to limit your exposure:

- Transfer Excess Funds Frequently: Don’t wait until the end of the day to move money. If you’re handling a high volume of transactions, make multiple bank deposits or digital transfers throughout the day.

- Encourage Transfers Over Withdrawals: Let your regular customers know they can pay bills or send money directly through you. The more digital your operations, the less cash you’ll carry.

- Avoid Flashy Habits: Don’t count large bundles of cash in front of people. Don’t discuss how much you made in a day, even in jokes. You never know who’s listening.

- Rotate Your Banking Patterns: Use different routes or times when going to deposit money. Predictability is dangerous. A robber doesn’t need to rob your shop; they can just wait for you on the road.

- Don’t Store Overnight: Never leave large cash sums in your shop overnight, no matter how secure you think it is. If someone breaks in and finds it, you’ve helped them succeed.

You don’t need to run a cash-heavy operation to make money. The more you reduce cash handling, the harder it becomes for robbers to see you as an easy target.

Vary Your Routines

One of the biggest mistakes many POS agents make is sticking to the same daily pattern. Criminals are watchers. They don’t need to strike on day one – they observe, take notes, and wait until your routine becomes predictable.

If they know when you open, close, deposit money, or even take lunch, they know when to strike.

Here’s how to make it difficult for criminals:

- Switch Your Opening and Closing Times Occasionally: Don’t always open at 8 a.m. or close at exactly 6 p.m. Change it up now and then. Unpredictability makes planning harder for would-be attackers.

- Change Your Deposit Schedule: If you always leave the shop to deposit money around the same time every day, that habit becomes a risk. Rotate your schedule and vary the bank routes you use.

- Avoid Obvious Patterns: Don’t always restock your cash float on the same days or follow the same route home. These little habits can make you easy to track.

- Watch Your Online Clues: Be careful what you post on WhatsApp statuses or social media. Announcing “market was hot today!” or “closing early to bank cash” can give away more than you think.

- Work in Pairs on High-Risk Days: Market days, salary weeks, or festive periods often mean more cash flow and more risk. If possible, have someone with you or nearby during these peak periods.

Robbers plan based on what they can predict. If you make your schedule harder to guess, you make their job harder, and your shop safer.

Install Basic Physical and Tech Security

You don’t need a million-naira setup to make your shop harder to rob. A few simple tools can create enough friction to discourage or delay criminals. And sometimes, that’s all it takes to avoid an attack.

Here’s what to focus on:

- CCTV Cameras: Even an affordable camera system can help. Visible cameras act as a warning to thieves, and recorded footage can help during police investigations if anything happens. You can get a basic wireless CCTV camera on Jumia. Mini wireless models start from around ₦14,999. Pan‑tilt models with night‑vision features cost around ₦17,300–₦20,000. You can begin with a single affordable unit under ₦20k and scale up later.

- Motion Sensor Alarms: These low-cost devices can alert you to unusual movement when you’re away from the counter or when the shop is supposed to be closed.

- Secure Locks and Doors: Don’t rely on cheap padlocks. Use reinforced locks, metal doors, and tamper-resistant latches for both your front door and cash storage.

- Power Backup for Security Devices: If your area has unstable power, use a small inverter, rechargeable battery, or solar backup to keep cameras and lights running even when NEPA fails.

- Glass Barriers or Screens: If possible, install a small counter shield. Even a simple screen gives you a little protection and control.

- Well-Lit Shop Exterior: Robbers hate bright areas. Install a solar-powered motion light outside your entrance to keep your space visible at night.

You don’t have to look like a fortress; all you need is to create enough resistance that criminals decide you’re not worth the risk.

Hire or Collaborate with On-Site Security

Most POS agents can’t afford to hire full-time security. But that doesn’t mean you’re out of options. You can still protect your business by thinking smart and partnering with the right people around you.

Here’s how:

- Work With Market or Plaza Security: If your shop is inside a market or shopping plaza, find out if there’s a shared security arrangement. Many places have night guards, gate controls, or vigilante partnerships; plug into those systems.

- Partner With Nearby Shops: Team up with other agents or business owners in your area to hire a shared guard or set up a rotation for watching each other’s shops, especially during closing hours.

- Involve Local Vigilante Groups: In many communities, local vigilante groups do regular patrols. If you operate in a high-risk area, talk to them about adding your location to their rounds, even if it means a small monthly support fee.

- Know the Nearest Police Post: You don’t have to be friends with the whole station, but at least know who to call. Save the local DPO or patrol contact on your phone. You should also know which direction to run or send help requests during an emergency.

- Be Present During Peak Hours: If you can’t afford extra hands, try to avoid leaving the shop unattended during busy hours. Even a quick errand can be enough time for a thief to strike.

Security is often a team effort. You don’t have to do it alone – your environment, neighbours, and local authorities can all be part of your defence strategy.

Train Staff and Family Helpers on Security

Running an agent banking shop often means working with people you trust, like a younger sibling, a spouse, or even a hired assistant. But trust alone isn’t enough. If they don’t understand how to stay safe, they can put everyone (and the money) at risk.

Here’s what to train them on:

- No Cash Display: Teach them never to count money in front of customers or display large amounts of cash on the table. Even regular customers can become informants for criminals.

- Stay Alert, Not Distracted: No loud music, no headphones, and no endless chatting. Anyone operating the POS needs to stay aware of their surroundings at all times.

- Know the Panic Protocol: What should they do if someone suspicious enters? If a robbery happens? If they’re alone and feel unsafe? Everyone helping you should know the plan — who to call, how to signal for help, and what to avoid doing.

- Keep Phones Unlocked & Charged: In emergencies, they should be able to reach you, the police, or neighbours immediately – no fumbling with passwords or dead batteries.

- Don’t Overshare Personal Info: They shouldn’t tell customers where you live, how much you made yesterday, or where you go to deposit cash. Loose talk can become a security leak.

- Keep a Professional Tone: Teach them to be polite but firm. Avoid over-familiarity with customers, especially ones who ask too many personal or business questions.

Training doesn’t have to be formal. But you do need to repeat it regularly. Safety habits should become second nature, not something people only remember after an incident.

Watch for Suspicious Activity

Robbers rarely strike out of nowhere. They often test the waters first – loitering around your shop, asking strange questions, or watching from a distance. The ability to spot suspicious behaviour early can save you from a dangerous encounter.

Here’s what to look out for:

- People Hanging Around Without Purpose: Be cautious of individuals who spend too much time near your shop without doing any actual transaction. Especially if they’re always watching, pacing, or pretending to be on the phone.

- Repeated Visits Without Transactions: If someone shows up multiple times in a day or week and never makes a transaction — but keeps asking questions — take note.

- Unusual Questions: Be wary of people who ask things like:

- “What time do you close?”

- “How much do you make in a day?”

- “Where do you keep your cash?”

- “You dey sleep here sometimes?”

- Large Group Walk-ins: Be alert when multiple people walk in at once, especially if they start spreading out or distracting you. It could be a planned setup to confuse or overwhelm you.

- Unfamiliar Faces on Peak Days: During salary weeks or market days, keep an extra eye out. That’s when you’re most likely to be targeted, especially by outsiders posing as customers.

What You Can Do When You Notice Suspicious Activity

- Trust Your Gut: If someone gives you a bad feeling, don’t ignore it. Take note, pause the transaction if needed, and stay sharp.

- Have a Signal Plan: If you work with someone else, agree on a silent signal (e.g., tapping the table twice or saying a code word) to indicate something feels off.

- Politely Shut Down Overly Personal Questions: You don’t owe anyone an answer about your business or cash flow. A simple “I no dey talk that one” works.

Security is as much about awareness as it is about gadgets. If you can spot trouble before it starts, you have a far better chance of avoiding it.

Join Agent Associations or Safety Networks

There are thousands of POS agents across Nigeria dealing with the same risks you face. The smartest agents don’t wait until something happens to them. They plug into local networks where information, support, and early warnings are shared.

Here’s why joining a network matters:

- You Hear About Threats Early: When an agent gets robbed in your area, others in the group usually hear about it first. That gives you time to adjust your schedule or tighten up your security.

- You Learn From Other Agents’ Mistakes: Someone may share how they got scammed, distracted, or followed. These stories become free lessons for you.

- You Can Organize Group Security: Agents in the same street, market, or LGA can come together to fund a shared vigilante or neighbourhood watch. One agent can’t pay for everything, but ten agents chipping in ₦2,000 each? That’s doable.

- Banks and Fintechs Take You More Seriously: Many platforms like Moniepoint, Opay, and Palmpay are more responsive when you belong to a registered group. It also opens doors to training, support, and security tools.

- You Get Backup in a Crisis: If something goes wrong – robbery, assault, police harassment – your network can help you raise an alarm, get attention, or even provide emotional support.

Wondering where to start?

- Join your LGA’s agent WhatsApp or Telegram group

- Attend meetups organized by your aggregator or fintech platform

- Register with your local market association or business forum

Information is protection. When agents talk to each other, everyone gets safer.

Get Insurance or Protection Services

Sadly, insurance is not part of the business culture in Nigeria. That’s why most agent bankers in Nigeria don’t think about insurance until something bad happens. But if your business handles cash daily, it’s worth considering some form of financial protection.

Even a basic insurance policy could help you recover from a loss and keep your business running.

Here Are Some Insurance Vehicles to Look Into

- Fintech-Provided Protection: Some agent platforms like Moniepoint, Palmpay, or Opay offer robbery or fraud insurance as part of their agent packages. Ask your aggregator or dashboard rep what’s available and how to enroll.

- POS Insurance Packages: A few insurance companies now offer micro-business or POS-targeted policies. These can cover:

- Robbery and theft

- Equipment damage

- Personal injury during a robbery

- Cooperative Insurance Options: If you belong to an agent association or trade union, ask if there’s a group insurance plan. Group plans are usually cheaper and more flexible.

- Personal Life or Health Cover: It’s not just your shop at risk, it’s also you. Consider low-cost life or health cover, especially if you’re the main provider for your family.

Important Things to Note When Getting Insurance

- Read the fine print. Know what’s covered, what’s not, and how claims are processed.

- Ask other agents for feedback before committing to a plan.

- Start small. Any cover is better than none.

You work hard for your money. Don’t let one robbery wipe everything out. Protection gives you peace of mind and a chance to bounce back if things go wrong.

To Wrap Up: Don’t Wait to Become the Next Headline!

Agent banking is a smart way to earn a living, but it also comes with real risks. Robbery isn’t a far-off possibility; it’s a growing threat that many agents across Nigeria have already faced. Waiting until it happens to you is not a plan.

The good news? You don’t need to be helpless. By choosing the right location, handling cash wisely, installing basic security, varying your routine, staying alert, and leaning on your community, you can make your business a lot harder to target.

Start with what you can do today. Talk to your assistant. Move your cash earlier. Join a WhatsApp group for agents in your area. Little by little, you build a wall that’s hard for criminals to break through.

Security is all about being prepared, being smart, and staying in business.

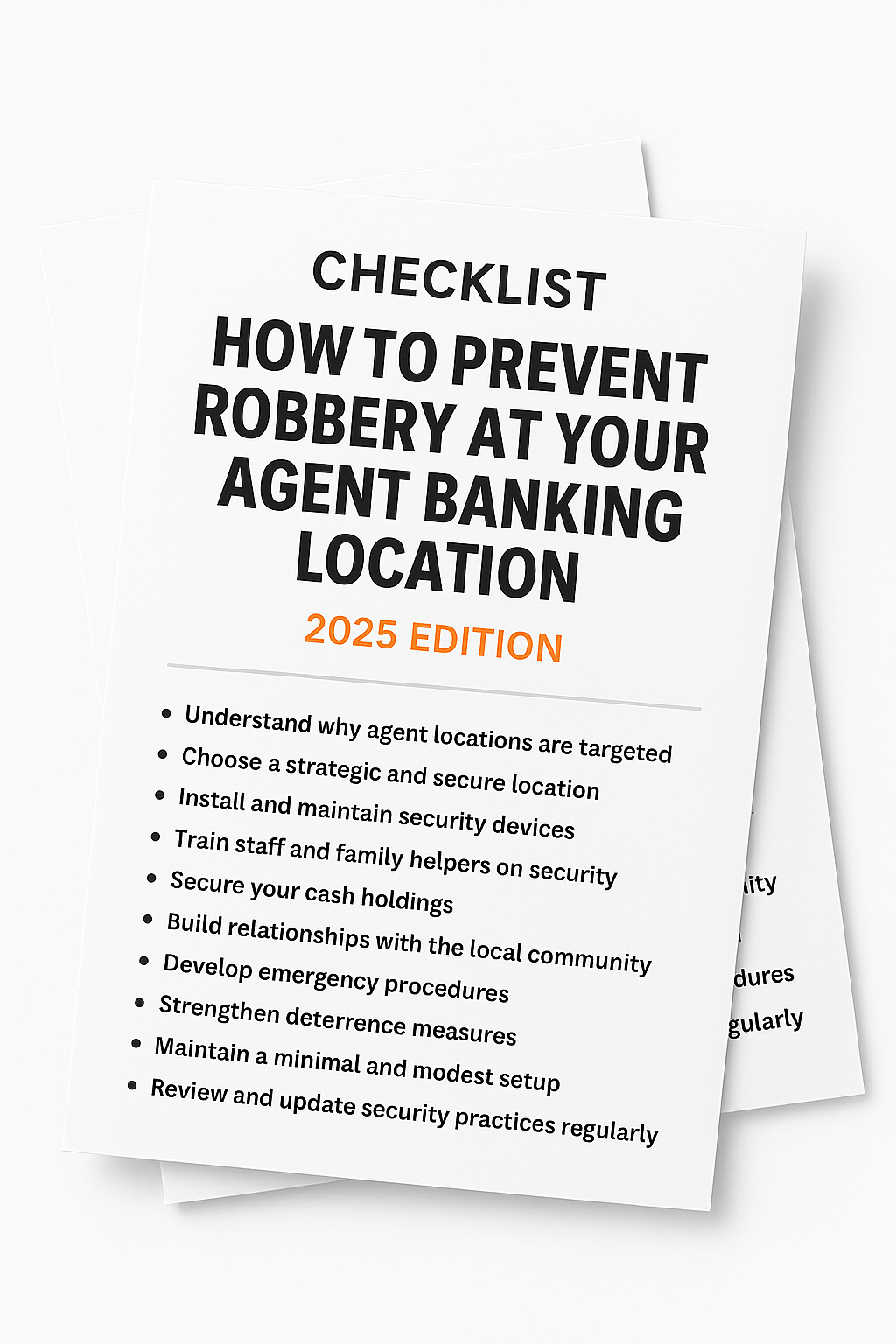

FREE Download: Agent Banking Security Checklist (2025 Edition)

We’ve put together a clean, easy-to-follow PDF version of this checklist – perfect for printing and keeping at your agent shop and sharing with your team. It covers all 10 smart strategies you can use to prevent robbery and protect your business in 2025.

Fill out the short form below to download your copy instantly.

Stay safe. Stay smart. Stay one step ahead.